Time and Money are Everything

Raising venture capital is a 6—9 months process, precious time which could spent growing your business.

VC and angel funding is harder than ever and most banks don’t have loan products for companies with no hard assets (i.e. collateral).

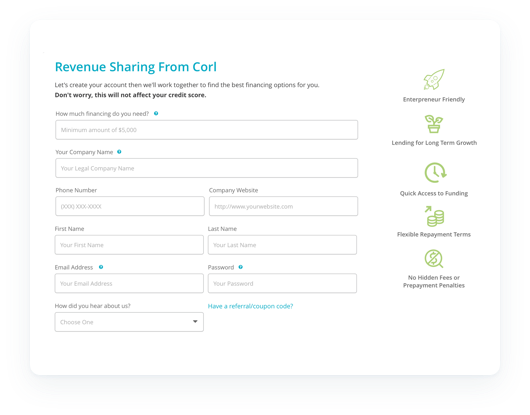

Corl's revenue-sharing investments help you access flexible capital for long-term growth without the restrictions associated with traditional debt financing or equity dilution. We call it, Capital-as- a-Service.

English

English French

French Hindi

Hindi Italian

Italian Arabic

Arabic Dutch

Dutch German

German